12-13 May 2026

Rome, Italy

About the Summit

Alea Global Group will return once again in 2026 to gather more than 70 of the region’s most prominent family offices together for our European Family Office Investment Summit. Now a firm fixture in the calendar of family offices in the region, as well as those who want to do business with them, we are delighted that the Summit has gone from strength to strength since our first such event in London in 2021.

Our programme this year incorporates evergreen family office issues such as succession planning, the latest in real estate investment, private equity and wealth management. Added to this we will take a look at new geopolitical developments affecting international investment, and newer areas of investment such as AI and digital assets. We will also take a look at cultural investment and national identities in Europe, including how and why countries distinguish themselves from one another so clearly in the region.

Alea Global Group network draws family office members themselves to participate in our events. This, along with our strategic programming and intimate scale, offers service providers an unparalleled opportunity to speak with decision-makers directly at the Summit.

Our Story

The Alduaij family office has a long and illustrious history in Kuwait as one of the most prominent and respected business forces in the region, as well as one of the most socially responsible.

Through their networks, Alea Global have formed strong personal and professional relationships with other family offices across the globe, all sharing much common ground and a willingness to work together.

From this network, experience and expertise, a series of successful Family Office Investment Summits has arisen, attended by ruling and elite families from every region with an historic and enduring influence on the global economy.

Our Third Europe Family Office Investment Summit is the latest of these, building on the success of other such summits around the world.

As a family office ourselves – as well as your conference host – we understand the needs, concerns and wishes of family businesses better than anyone else. We share many of your experiences and objectives, and we understand what makes an event like this beneficial to family offices as well as service providers.

Previous Highlighted Speakers

Agenda

14:00 Registration

Registration and Networking.

15:30 Welcome

Welcome and opening remarks.

15:40 The Future of Private Equity: Navigating Cycles, Sectors, and Sustainability

- Assessing how economic cycles, interest rate environments, and valuation pressures are reshaping private equity strategies.

- Identifying growth sectors – from technology to healthcare to energy transition – that align with family office priorities.

- Embedding ESG, impact, and governance considerations into private equity portfolios for resilience and relevance.

16:10 Sustainable Investing Beyond ESG: What Works in 2026?

- Moving beyond greenwashing to measurable impact strategies

- Direct investments in clean energy, circular economy, and agri-tech

- The regulatory push: How SFDR and EU taxonomy shape decisions

- Balancing financial returns with genuine sustainability goals

16:50 Roundtable Discussions

With peer learning and interaction in mind, these 60- minute breakout sessions are designed to promote the sharing of experiences and brainstorming of ideas in facilitated and balanced discussions.

17:50 Evening Networking Break

18:20 Navigating uncertainty in Europe and beyond

- Adapting to evolving EU relations and regulatory shifts affecting investment strategy, tax implications, and family office compliance

- Assessing the impact of global tensions on European markets, asset classes, technology sectors, and energy investments

- Opportunities and risks in Europe’s push for energy independence and the acceleration of green initiatives

- The unique position of family offices in fostering European innovation, tech startups, and impact-driven projects

19:00 Presentation: Exciting investments to enliven your portfolio

19:20 Balancing Tradition, Transparency, and Reality in Family Office Governance

- How evolving regulatory frameworks and global scrutiny are reshaping governance standards for European family offices.

- Building governance structures that preserve family values while enabling professionalised decision-making and generational continuity.

- Leveraging technology, risk management, and independent oversight to future-proof governance models.

20:00 Closing Remarks

Closing Remarks For Day One.

20:10 Networking Dinner

A chance to meet and discuss the day one sessions over dinner.

08:30 Registration

Registration and Networking.

09:30 Welcome

Welcome and opening remarks.

09:35 Presentation: Economy Overview

09:50 Private Equity in a Higher-for-Longer Rate Environment

- Adjusting valuation models amid persistent inflation and tight capital

- The appeal of secondaries and co-investments in a constrained market

- Sector spotlight: Where are European family offices deploying capital?

- Lessons from recent exits and liquidity events

10:20 The Digital Wealth Revolution: AI, Blockchain & Family Offices

- How generative AI is transforming investment decision-making

- Tokenization of assets: Real-world adoption in private markets

- Cybersecurity threats and protecting family office data

- Building a tech stack for the next decade’s wealth management

11:00 Morning Networking Break

11:30 Geopolitical Risk & Asset Protection Strategies

- Safeguarding wealth amid rising political and economic instability

- The role of gold, cryptocurrencies, and offshore structures in 2025

- Navigating sanctions, trade wars, and shifting regulatory landscapes

- Case studies: Family offices that successfully hedged geopolitical shocks

12:10 The Future of European Real Estate Investing

- Assessing post-pandemic opportunities in commercial and residential markets

- Navigating regulatory shifts in ESG-compliant real estate investments

- The rise of alternative assets: data centers, life sciences, and logistics

- Co-investment strategies to mitigate risk and enhance returns

12:50 The next big thing

Our pick of the best investment opportunities for the next 6 months.

13:10 Networking Lunch

A chance to meet and discuss the morning’s sessions over lunch.

14:10 Preserving Capital, Seizing Opportunities, and Managing Risk Across Generations

- Crafting investment strategies that balance long-term preservation with exposure to emerging asset classes.

- Integrating sustainability, impact, and ESG considerations into multi-generational wealth management.

- Navigating volatility, inflation, and geopolitical uncertainty through disciplined allocation and risk management frameworks.

15:00 Presentation: Engineering excellence in your investment portfolio

15:20 Next-Gen Leadership & Succession Planning

- Bridging the gap between founders and heirs in wealth transition

- Balancing tradition with innovation in family governance structures

- Preparing the next generation for stewardship and impact investing

- Case studies of successful – and failed – succession plans

16:00 Afternoon Networking Break

16:30 Venture Capital & Deep Tech: Europe’s Competitive Edge?

- Investing in AI, quantum computing, and climate tech at scale

- The role of family offices in bridging the Series B+ funding gap

- Balancing high-risk bets with portfolio diversification strategies

- Success stories: European unicorns backed by family capital

17:00 Open Discussion: Direct Investments, Co-Investments, and the Shift Beyond Traditional Funds

- Evaluating the rise of direct deal participation and co-investments as family offices seek greater control and returns.

- Building networks and partnerships to access high-quality private equity opportunities in a competitive landscape.

- Balancing illiquidity risk with long-term value creation across sectors and geographies.

17:30 Closing Remarks

Closing Remarks For the summit.

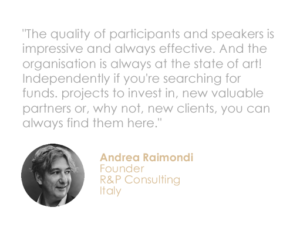

What our attendees say

Turquoise

Turquoise

Jade

Sponsors

We are extremely grateful for the support of our sponsors, who help to make all this possible.

View full speaker bios and company information here.

Sponsors

We are extremely grateful for the support of our sponsors, who help to make all this possible.

Get in touch with us

Jade

Sponsors

We are extremely grateful for the support of our sponsors, who help to make all this possible.

Email us at info@aleaglobalgroup.com.

Please Note: Registration is subject to Advisory Board approval and payment of attendance fee.

Terms and Conditions Apply.

Previous Summit Partner

Previous Co-branding Partner

Summit Partner

Co-branding Partners

Sponsors